The uit due for each employee is computed by multiplying the lesser of total wages or remuneration paid to the employee or the 2017 maximum taxable threshold of $10,900 by the unemployment insurance contribution rate, which ranges from 1.3% to 9.1% based on the employer’s individual experience in the unemployment insurance system. Note that some states require employees to contribute state unemployment tax.

Disastrous 15/hr Minimum Wage Struck Down in Major U.S

Disastrous 15/hr Minimum Wage Struck Down in Major U.S

New york state's jobless claims represent 5% of the nation's filings in the last five weeks.

Nys unemployment insurance rate. The amount of your weekly unemployment insurance benefits depends on your prior earnings. How it works and how much it’ll help will be pressing questions, as the effects of the outbreak reverberate. Total weeks of unemployment available:

Following is a preliminary list of the 2020 state unemployment insurance (sui) taxable wage bases (as compared to 2019) and employee sui withholding rates, if applicable. The minimum pua benefit rate is 50% of the average weekly benefit amount in new york. What is the nys unemployment insurance rate?

Each employer contributes 2.5% of the employee’s pay toward unemployment insurance. The unemployment rate in new york peaked in july 2020 at 15.9% and is now 6.3 percentage points lower. For 2020, the new employer normal contribution rate is 2.5%.

According to the bls current population survey (cps), the unemployment rate for new york fell 0.1 percentage points in october 2020 to 9.6%.the state unemployment rate was 2.7 percentage points higher than the national rate for the month. This article highlights some of the common areas of dispute arising out of unemployment insurance claims that the new york department of labor (dol) has previously ruled upon. I am facing eviction from my home, my dte on the verge of disconnection right before winter, s/o moved out, empty pantries for feeding my two beautiful girls, and was feeling helpless having no on to turn to for help, and no clue how to give christmas to my sweet girls.

Cares act expanded unemployment programs in addition to new claimants, workers who were already collecting or have exhausted unemployment insurance are eligible for augmented benefits. Sui tax rate by state. Size of fund index column:

This rate is the same for each employer and this is all it takes to cover employees if they become unemployed under the right circumstances. * the unemployment insurance contribution rate is the normal rate plus the subsidiary rate. State taxes on unemployment benefits:

Enter your federal employer identification number (fein) and employer registration number (er#): Employers finance the program through the sui tax. States use two primary methods for determining an employer’s ui tax rate.

Blank forms are available for download from the employer forms and publications section of the dol website. A preliminary look at the 2020 state unemployment taxable wage bases. Welcome to the new york state department of labor unemployment insurance employer home page.

The cares act extended the duration of ui. The current futa tax rate is 6%, but most states receive a 5.4% “credit” reducing that to 0.6%. • employer rights, responsibilities, and filing requirements • new york state unemployment insurance • new york state wage reporting • new york state, new york city, and yonkers income tax withholding

Unemployment insurance is a crucial safety net, providing a temporary cash cushion. We explain how this rate is calculated. Nys unemployment insurance total ui contribution rates.

Wage bases shown in bold changed from the prior year. Please help., unemployment, 3 replies drop in nys unemployment rate shortens weeks of unemployment benefits, unemployment, 4 replies Pua is available for periods of unemployment between january 27, 2020 and december 31, 2020.

If you disagree, you may request a hearing within 30 days from the date of the determination. You must file an unemployment insurance claim to find our if you are eligible and learn your actual benefit amount. There is no action an employer can take to affect this rate.

This aligns with the national. This rate cannot exceed 3.4%. If you are found ineligible to receive unemployment insurance benefits, you will receive a determination explaining the reason.

2% (on taxable income from $4,600 to $9,099). The federal unemployment tax act (futa) tax is imposed at a flat rate on the first $7,000 paid to each employee. For 2020, the new employer normal contribution rate is 2.5%.

Unemployment is funded, and taxed, at both the federal and state level: If you are not eligible for those benefits, you may be eligible for pandemic unemployment assistance (pua). For an employee to be disqualified for an unemployment insurance claim, the employee must have (1) voluntarily separated from the employment and (2) done so without good.

Using the example above, the minimum amount for traditional unemployment benefits in new york is $104 per week for 39 weeks. In the week ended april 18, 204,716 new yorkers filed for unemployment insurance (ui). Do employees pay a nys unemployment tax?

New york state unemployment insurance details: Arkansas began taxing unemployment benefits in 2018. Nys unemployment insurance (ui) is temporary income for eligible workers who lose their jobs without their own fault.to collect new york state unemployment insurance benefits, you must be ready, willing/able to work, and actively looking for work during each week in which you are claiming benefits.

A place for your unemployment insurance questions. If you are eligible for regular unemployment insurance benefits or pandemic emergency unemployment compensation (13 additional weeks), an additional $600 per week will be added to your benefit rate until the week ending 7/26/2020. Find your company's state unemployment insurance (sui) tax rate.

The maximum amount of weekly traditional unemployment benefits in new york is $504.00 per week for 39 weeks. 2.5% but less than 3.0%. This rate is fixed each year according to the size of the unemployment insurance trust fund.

State unemployment insurance (sui) is a nationwide program. It provides partial wage replacement to unemployed workers, while they look for jobs.

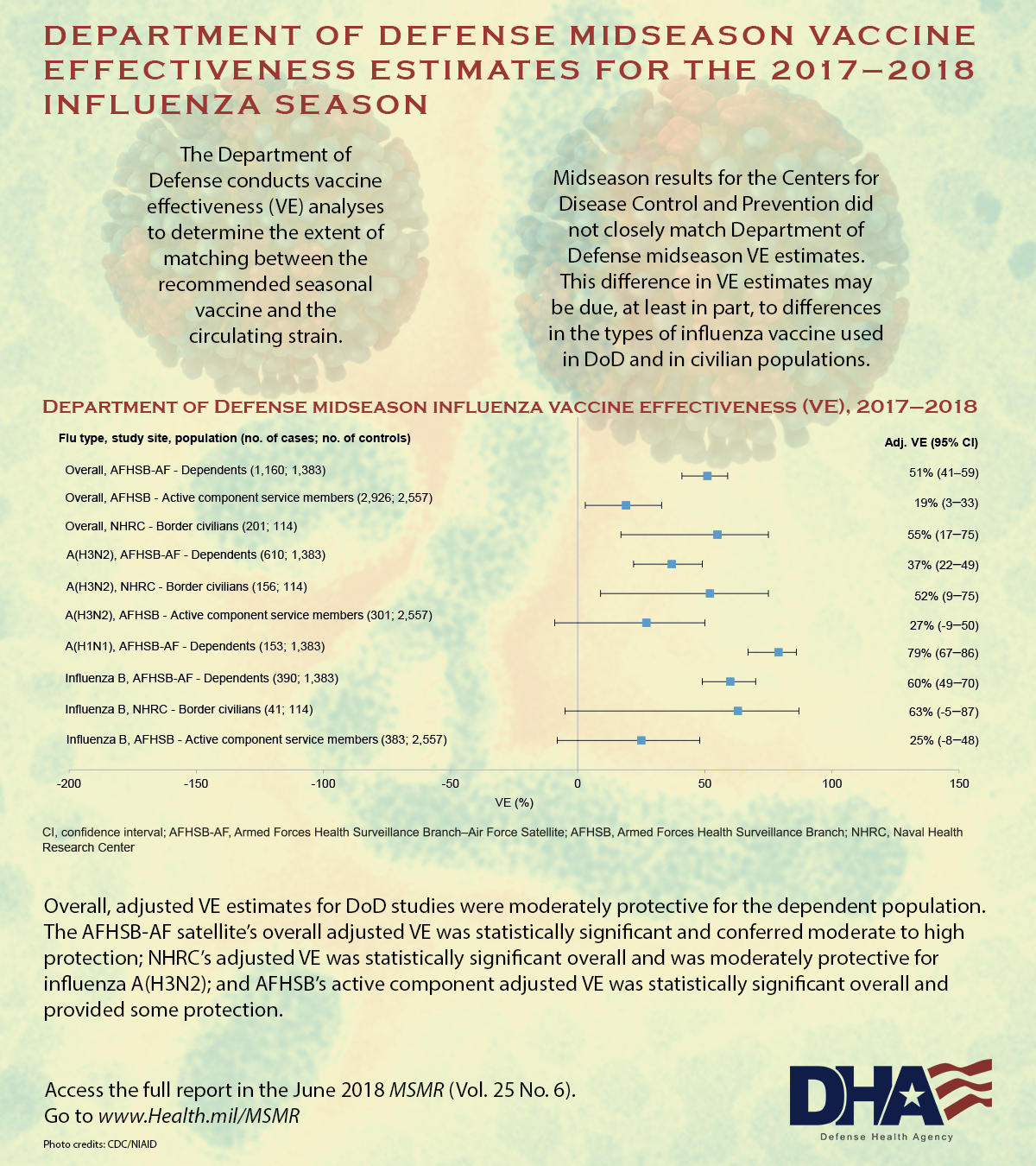

3 total vaccine effectiveness was estimated at 36 according to a report released. The experts say the effectiveness rate of flu shots should be at least 90 successful.

How Effective Is Flu Vaccine Express Co Uk

How Effective Is Flu Vaccine Express Co Uk

GETTY Images The flu vaccine varies in effectiveness dependent on the type of influenza viruses in the environment.

Flu vaccine success rate. In general current flu vaccines tend to work better against influenza B and influenza AH1N1 viruses and offer lower protection against influenza AH3N2 viruses. The vaccine is generally around 40 percent effective in protecting. The percentage of participants in each site who had received the flu vaccine ranged from 38 to 61.

The remaining 70 to 40 percent of people could still contract the flu but experience a milder and. Why flu vaccines so often fail. 269 effective in children aged 2 to.

The infection rate in adults drops. 20 2017 230 PM. In general influenza vaccine effectiveness has been found to vary between 30-60.

Since health officials started tracking it in 2003 effectiveness of the flu shot has varied from year to year averaging at 40. From the results they calculated an odds ratio. This is consistent with estimates of flu vaccine effectiveness VE from previous flu seasons that ranged 40-60 when flu vaccine viruses were similar to circulating influenza viruses.

Seasonal Influenza Vaccine Effectiveness 2005-2016 - CDC. This implies that on average a vaccinated person is 30-60 less likely to experience the outcome being measured eg. However effectiveness varied considerably.

The flu vaccine is being oversold its not that effective. By age-group the vaccine was overall. But activity began picking up in January and.

While vaccine effectiveness VE can vary recent studies show that flu vaccination reduces the risk of flu illness by between 40 and 60 among the overall population during seasons when most circulating flu viruses are well-matched to the flu vaccine. E arly estimates suggest the flu shot only worked about a third of the time this year. By Jon Cohen Sep.

A vaccine is assessed by its efficacy the extent to which it reduces risk of disease under controlled conditions and its effectiveness the observed reduction in risk after the vaccine is put into use. CDCs influenza vaccination coverage reports show that overall flu vaccination coverage among people 6 months and older during 2019-2020 increased from the previous season to nearly 52. Influenza leading to attendance at a general practice or hospitalisation than an.

Flu vaccines for instance are between 40-60 effective but help save lives. In the case of influenza effectiveness is expected to be lower than the efficacy because it is measured using the rates of influenza-like illness which is not always caused by. The US Centers for Disease Control and Prevention CDC estimated that during the 2018-19 season the vaccine.

So far this season flu vaccines are reducing doctors visits for flu illness by almost half 45. The data show that overall flu vaccine was 15 effective in all age groups. That said during the more moderate 2016-17 flu season when the flu vaccine was estimated to be 40 overall effective flu vaccines prevented an estimated 53 million flu-related illnesses and 26 million medical visits according to the CDC.

But data collected for nearly two decades by the US Center for Disease Control and Prevention show. CDC has been working with researchers at universities and hospitals since the 2003-2004 flu season to estimate how well flu vaccine works through observational studies using laboratory-confirmed flu as the outcome. Flu Vaccine Effectiveness Networks.

The shots effectiveness and higher-than-average early-season vaccination rates have contributed to a comparably mild flu season this year. According to BBC Reality Check the annual jab prevents 30 to 60 percent of people on average. The protection of the flu vaccine is minimal and may not be worth it.

The influenza virus has yet to hit the Northern Hemisphere but flu vaccine season is already in full swing with banners. Maldonadowith 40 to 60 percent being the average rate of. Vaccination is providing substantial protection VE 55 for children who have been particularly hard hit by flu this season.

Generally speaking though the vaccines effectiveness can vary from as little as 10 percent to as much as 60 or 70 percent says Dr.

The cap rate calculator short for capitalization rate is a useful tool as it allows you to quickly get an estimate for how much money a property is expected to make and how this compares to similar properties in the area. Using the above cap rate formula we can calculate the capitalization rate of the building is.

How To Figure Cap Rate Rental Property Investment Real Estate Investing Rental Property Getting Into Real Estate

How To Figure Cap Rate Rental Property Investment Real Estate Investing Rental Property Getting Into Real Estate

However what they all have in common is price of the property and the capitalization rate otherwise known as the cap rate.

How to calculate cap rate. 1000000075000000 1333. To figure out the cap rate for a property begin by calculating the gross income youll earn from it each year through rent or other sources of income. Capitalization Rate BLOGTOBER 8.

Simply enter your NOI and purchase price or market value. Annual Income Annual income is the total value of income earned during a fiscal year. The capitalization rate calculator gives you the propertys cap rate by dividing the net operating income NOI by the property value and multiplying that number by 100.

When income and value grow at a constant rate then the discount rate is equal to the cap rate plus the growth rate. To explain this lets use a simple example. In the real estate lending and appraisal sector the cap rate is a valuable metric that uses the amount of income a property is able to generate as the means of estimating that propertys value.

A cap rate calculator is a tool that helps you determine the rate of return on your real estate investment. After the investor fills in the inputs the cap rate calculator will give an output of your capitalization rate. To calculate the cap rate of a property you simply divide the NOI by the value of the property.

Use the calculator below to calculate your cap rate. The cap rate calculator can be used to accurately calculate the capitalization rate of real estate. 24000 in expenses divided by the 300000 sales price gives you a capitalization rate of 08 or 8 percent.

Now divide that net operating income by the sales price to arrive at the cap rate. To figure out the NOI you multiply your gross rental income by your occupancy rate and then subtract operating expenses from your gross rental income. Suppose an office building which gives a net operating income of 10000000 is valued at 75000000.

A high cap rate indicates a very positive cash flow that the property generates which is great news. It includes inputs such as property value gross annual rental income operating expenses and vacancy rate. Basically the cap rate is the ratio of net operating income NOI to property value or sales price.

This calculation will give you a percentage that indicates the annual return on your investment. Cap rate net operating income property value. How to Calculate the Cap Rate Using the Discount Rate Another way to calculate the cap rate is based on the relationship between the cap rate and the discount rate.

Calculating the cap rate usually helps real estate investors evaluate the investment property properly. Gross annual income refers to all earnings before any deductions are. Although the basic structure of the calculation is straightforward there are a lot of factors that may affect the cap rate of a property.

Calculating cap rate is relatively simple as long as you have the propertys net operating income NOI. It is used by the investors to evaluate real estate investment based on the return of a one year period. In other words this ratio is a straightforward way to measure the relationship between the return generated by the property and the price of it.

Let us start with a listing example. Remember to calculate NOI subtract all expenses related to the property excluding mortgage interest depreciation and amortization from the propertys income. You can use our free cap rate calculator below and learn more about how this is calculated further down the page.

The formula for Cap rate or Capitalization rate is very simple and it is calculated by dividing the net operating income by the current market value of the asset and is expressed in terms of percentage. The formula for Cap Rate is equal to Net Operating Income NOI divided by the current market value of the asset. The resulting cap rate value is then applied to the property an investor wants to purchase in order to obtain the current market value based on its annual income.

How to Use the Cap Rate. Net operating income is the annual income. The formula for calculating the cap rate.

Then subtract your operating expenses from that to calculate your net income. Some listings have more information than others. The cap rate is calculated by taking the net operating income of the property in question and dividing it by the market value of the property.

The arrow points you to the cap rate. However you should keep in mind that the cap rate is an annual ratio therefore the percentage you get is per year. Capitalization rate is calculated by dividing a propertys net operating income by the current market value.

A cap rate is calculated by dividing the Net Operating Income NOI of a property by the purchase price for new purchases or the value for refinances. This ratio expressed as a percentage is an estimation for an investors potential. Capitalization Rate Examples Example 1.

Cari Blog Ini

Label

- 1000rr

- 1040ez

- 1080p

- 12th

- 15th

- 1600x900

- 1920x1080

- 1969

- 1971

- 2000

- 2007

- 2013

- 2015

- 2016

- 2017

- 2018

- 2019

- 2020

- 2021

- 2160p

- 2560x1600

- 2pac

- 38mm

- 4matic

- 50th

- 60th

- a380

- above

- abscess

- abstract

- academia

- accent

- accord

- accounting

- acorn

- acoustic

- acrylic

- activate

- activity

- actor

- actress

- acts

- adaan

- adapter

- adding

- adelaide

- adidas

- aditya

- adjust

- adjustable

- administration

- adopt

- adrenalin

- adults

- advantages

- advice

- aerial

- aesthetic

- african

- after

- against

- agency

- ages

- agrawal

- agreement

- airbus

- akira

- album

- alcohol

- alexa

- alien

- allocation

- alphabet

- alternative

- alzheimers

- amazing

- amazon

- amazonca

- america

- american

- anak

- android

- aneka

- angebote

- angles

- angry

- animal

- animals

- animated

- Animation

- anime

- anna

- anne

- annie

- anniversary

- answers

- anti

- appetit

- apple

- application

- apply

- apron

- arabic

- architectural

- area

- ariel

- army

- around

- artists

- artwork

- asam

- asem

- asian

- asli

- astigmatism

- astrazeneca

- attorney

- audio

- austin

- australia

- authentic

- auto

- autumn

- availability

- avatar

- avengers

- average

- ayam

- azerbaijan

- baba

- babi

- babies

- baby

- back

- background

- backgrounds

- backpack

- backyard

- badan

- badge

- bahasa

- bajaj

- bakar

- baking

- bakpao

- bakso

- balaji

- balance

- balap

- balcony

- bali

- ball

- balloon

- balls

- band

- bandeng

- bands

- bandung

- bank

- banyak

- barbeque

- barn

- basah

- baseboards

- based

- baso

- bass

- bathroom

- bathtub

- batman

- bawang

- bayam

- beach

- bean

- bear

- beatrice

- beautiful

- beauty

- bebek

- become

- bedroom

- bedrooms

- beginner

- beginners

- beginning

- bein

- bekal

- believe

- belle

- belut

- bembeng

- bening

- beras

- berkuah

- best

- betutu

- bexsero

- bharma

- bible

- bicycle

- bihun

- bikang

- bike

- bikes

- bikin

- bill

- biohazard

- bird

- birth

- birthday

- birus

- bistik

- bites

- black

- blank

- blanket

- blaziken

- bleed

- blends

- blessed

- blick

- blissey

- block

- blossom

- blue

- bluetooth

- blush

- bobbin

- bogor

- bohemian

- boho

- bola

- bolen

- bollywood

- bolot

- bolu

- bomb

- book

- bookey

- books

- boost

- border

- boston

- botafogo

- botox

- bottle

- boujee

- bouquet

- bowood

- boxwood

- boyfriend

- boys

- bpjs

- brand

- breaking

- breast

- brick

- bridal

- bride

- bridge

- brock

- brooklyn

- brother

- brown

- brownies

- brush

- buah

- buat

- bubbles

- bubur

- buddha

- budget

- budgeting

- bugis

- bugs

- buka

- bull

- bulldog

- bumbu

- bundle

- bungalow

- buono

- burton

- business

- butter

- butterfly

- buying

- cajun

- cake

- cakes

- calculate

- calendar

- call

- calla

- calligraphy

- calories

- camaro

- camera

- cameras

- camo

- campur

- canada

- cancelled

- candy

- canvas

- capcay

- cape

- captions

- cara

- card

- cardinal

- cards

- cargo

- carnivores

- carolina

- cars

- cartier

- case

- casetify

- cast

- castle

- cats

- caulk

- causes

- cave

- cbr1000rr

- cecek

- cell

- cemilan

- cendol

- centerpiece

- centerpieces

- centre

- ceramic

- certificate

- chair

- chakra

- champion

- change

- chaplin

- chapstick

- character

- characters

- charge

- charizard

- charles

- charlie

- charmin

- chart

- charts

- chauth

- cheap

- checklist

- cheerleading

- chek

- chennai

- cherry

- chicago

- chicken

- chiffon

- child

- children

- childrens

- chinese

- chocolatos

- choirudin

- chore

- christmas

- chudi

- cider

- cigar

- cilok

- cilor

- cimol

- circle

- city

- cityscape

- civic

- clancys

- claro

- class

- clean

- cleaning

- clemente

- cling

- clinic

- clip

- clipart

- clothes

- clothing

- clover

- club

- coastal

- coat

- coco

- code

- coffee

- coffin

- coins

- coklat

- collage

- colonial

- color

- colorado

- colored

- colorful

- coloring

- colors

- colour

- colts

- columbus

- comfort

- command

- commentators

- commercial

- common

- compact

- companies

- comparing

- complete

- completely

- components

- comprehenshion

- comprehension

- computer

- computers

- concept

- conjugate

- connect

- consent

- conte

- contemporary

- contoh

- contraindications

- control

- controller

- controllers

- conventions

- cook

- cookies

- cool

- copier

- core

- corelle

- corner

- cornflakes

- corona

- coronavirus

- corps

- correct

- correcting

- corvette

- cost

- cough

- country

- couple

- coupon

- couponing

- coupons

- courthouse

- courtyard

- cover

- covered

- covid

- crafts

- crane

- cream

- creamer

- creases

- create

- createshake

- creative

- crispy

- crocodile

- croissant

- cross

- crossing

- crossword

- crunch

- crying

- crystal

- cuba

- cucur

- cudi

- cumi

- cups

- currency

- curry

- cursive

- custom

- customizable

- customized

- cute

- cyber

- cyberpunk

- cycle

- dadar

- daffodil

- daging

- daily

- dalgona

- dallas

- dame

- dance

- dancing

- dark

- dashboard

- date

- daughter

- davidson

- dawn

- deals

- debate

- debby

- debm

- decals

- decor

- decorating

- decoration

- decorations

- defender

- define

- definition

- delete

- deleted

- dello

- delonghi

- deluge

- denominators

- dental

- desert

- design

- designer

- designs

- desk

- desktop

- desktops

- dessert

- destiny

- devi

- device

- diabetic

- diagnosed

- diana

- dicembre

- different

- digest

- digit

- digraphs

- dijual

- dikhaiye

- dimensional

- dimsum

- dinamica

- dinosaur

- direct

- disc

- discord

- disease

- diseases

- disney

- disneyland

- display

- distemper

- distribution

- ditto

- division

- djum

- dnealian

- doberman

- doctor

- doctors

- documents

- does

- dogs

- dolch

- doll

- dollar

- dolphin

- domestic

- donat

- donuts

- door

- dora

- dorayaki

- dormify

- dosage

- dose

- dots

- down

- download

- downloadables

- downloader

- dragon

- dragonfly

- draw

- drawing

- dreams

- dress

- dresses

- driftwood

- drip

- drive

- drivers

- drone

- dtap

- dude

- duke

- dulha

- dulhan

- dunkin

- durga

- during

- dusanovac

- dynamite

- eagle

- earbuds

- earphones

- ears

- easy

- ebola

- economics

- edge

- edging

- education

- eevee

- effect

- effectiveness

- effects

- eggs

- eiffel

- elastique

- electricity

- elements

- eleven

- elizabeth

- elsa

- elves

- embossed

- embroidered

- employee

- empuk

- enak

- enchanted

- engine

- english

- enter

- enterprise

- entry

- envelope

- equations

- equivalent

- ergonomic

- escort

- espresso

- essential

- ethan

- etsy

- evaluation

- event

- everyone

- eviction

- evolution

- evolutions

- excel

- excelworksheetxlworkbookworksheetsget_item1

- exercice

- exercises

- explained

- explosion

- extensions

- extra

- eyebrows

- eyelash

- fabric

- face

- faces

- fact

- facts

- fall

- Family

- famous

- fancy

- Fantasy

- farm

- farmhouse

- fastest

- fauci

- feather

- feature

- feline

- felt

- female

- fence

- ferrari

- fessier

- fever

- fiction

- field

- fight

- figures

- file

- files

- fill

- financial

- find

- fingers

- fire

- firefighter

- firefly

- fires

- first

- firstever

- fish

- fitness

- five

- fixed

- flag

- flash

- flask

- flat

- fletcher

- flip

- floral

- florida

- flower

- flowers

- flue

- fluffy

- font

- food

- footage

- football

- ford

- foremost

- forest

- form

- forms

- formula

- formulas

- fortnite

- foto

- found

- fountain

- four

- fractions

- framed

- frames

- franxx

- free

- french

- friday

- friend

- frog

- from

- front

- frozen

- fruit

- full

- funding

- funky

- funny

- fvrcp

- gabus

- gacoan

- gadgets

- gagal

- galaxy

- gallery

- gambarnya

- game

- games

- gamestop

- gaming

- ganesh

- gardasil

- garden

- garland

- garpu

- gastly

- gaun

- gazzetta

- gears

- geico

- gender

- generalization

- generator

- geneva

- gens

- geometric

- gepuk

- gerem

- germania

- germany

- ghin

- giada

- giants

- gift

- gifts

- gilimanuk

- giovanna

- girls

- girly

- given

- glacier

- glass

- glazed

- glitch

- glizzy

- glock

- glow

- glycol

- gnome

- goddess

- godog

- gold

- gomez

- good

- goreng

- gorengan

- göttingen

- gown

- gowns

- goyang

- grade

- graders

- gradient

- grading

- graffiti

- grammar

- gran

- granada

- grande

- graph

- graphic

- graphics

- gratis

- grave

- gray

- great

- green

- grey

- grid

- grinch

- grinder

- groom

- grounds

- group

- gudangan

- gudeg

- guidebook

- guitar

- gula

- gulai

- gulf

- gulung

- gums

- gurame

- guys

- hack

- hackney

- hahnemuhle

- hair

- half

- halloween

- hallway

- hand

- handheld

- hands

- handwriting

- hanging

- hanuman

- happy

- hard

- hardware

- harley

- hartford

- harvest

- hatch

- hatchback

- have

- hd7447

- head

- headboard

- header

- headliner

- headlines

- headphones

- hear

- heel

- hepatitis

- herb

- heroine

- herringbone

- hidden

- hiden

- high

- highland

- hiroin

- hiscox

- History

- hitam

- hobby

- hogwarts

- holder

- hollywood

- home

- homemade

- homeowners

- homeschool

- homework

- honda

- honeycomb

- hoothoot

- horizontal

- horse

- hotel

- hotwire

- house

- housewarming

- houzz

- hulu

- hummingbird

- hunkwe

- hunt

- hunting

- huracan

- husband

- hustle

- hybrid

- iced

- icing

- iconic

- ideas

- ikan

- ikea

- ikonick

- illusion

- image

- imagebank

- images

- implants

- impressions

- indian

- indianapolis

- indications

- indigo

- indomie

- indonesia

- indonesianya

- industrial

- infinity

- influenza

- information

- ingredients

- initial

- injections

- injury

- inkblot

- insert

- inspiration

- inspirational

- install

- insurance

- interior

- intermediate

- internasional

- interview

- intra

- introduced

- invented

- inventor

- invitation

- invoice

- ipad

- iphone

- iran

- ireland

- iron

- islamic

- italian

- item

- jack

- jadi

- jadul

- jagung

- jahe

- jakarta

- january

- japanese

- jazz

- jeep

- jemblem

- jenang

- jengkol

- jenner

- jepang

- jesus

- jets

- jmsb

- jobs

- jogja

- john

- johnny

- johnson

- join

- jojo

- jolteon

- jordan

- journal

- jualan

- just

- kacang

- kaiser

- kalio

- kambing

- kannada

- kapal

- kare

- kari

- karstadt

- kate

- katiri

- katsu

- kaveri

- kawasaki

- keatas

- kebuli

- kecap

- keju

- kekinian

- kelly

- kemangi

- kembang

- kembung

- kemplang

- kentang

- kentucky

- kepala

- kepiting

- kepok

- kerala

- kering

- keripik

- ketan

- keurig

- keys

- khas

- kids

- kindergarten

- kindle

- kindness

- king

- kinkade

- kiss

- kitchen

- kits

- kitten

- klasik

- knot

- koala

- kobe

- kodak

- kodi

- kohls

- konidela

- konro

- kopi

- korea

- korean

- krecek

- krepes

- krishna

- krispi

- kristen

- kuah

- kukus

- kulit

- kuning

- kuniran

- kuno

- kylie

- label

- labels

- lacrosse

- ladies

- ladybug

- lake

- lakshmi

- lalapan

- lamborghini

- land

- landscape

- landscapes

- lapis

- laptop

- large

- lasagna

- laser

- latest

- latin

- latte

- lawsuit

- laxmi

- leaf

- league

- learning

- lease

- leather

- leave

- left

- legendary

- lehenga

- lembut

- lens

- leopard

- lesson

- lets

- letter

- letters

- level

- lezat

- liability

- library

- licence

- license

- life

- lifestyle

- light

- lighter

- lighting

- lights

- like

- lilin

- lilit

- lilly

- lily

- limited

- line

- list

- lists

- little

- live

- living

- lizzo

- lobby

- lock

- lodeh

- login

- logo

- lombok

- london

- long

- lontong

- look

- loose

- lord

- lose

- louis

- love

- lovers

- lowes

- lumer

- lumpia

- lumpur

- luther

- luxury

- lyme

- lyric

- lyrics

- machine

- mackinac

- macrame

- madden

- madison

- madura

- magicom

- magnet

- magnetic

- mahal

- mahalakshmi

- mahalaxmi

- maintenance

- majesty

- makanan

- make

- maker

- manchester

- manga

- manis

- mantel

- manten

- manual

- manufactures

- manufacturing

- many

- marble

- marilyn

- markers

- market

- marketplace

- marks

- marmer

- marriage

- martabak

- maryland

- masak

- masakan

- master

- mata

- matah

- math

- matted

- maury

- mayonaise

- mcdonalds

- mcgra

- meaning

- measles

- measure

- meat

- medan

- medicaid

- medicare

- meeting

- mehandi

- mehndi

- mein

- membrane

- membuat

- meme

- memes

- meningitis

- meningococcal

- mens

- mentega

- menu

- merah

- mercedes

- merck

- mercon

- mermaid

- merry

- messages

- metal

- mexican

- michael

- mickey

- micrometer

- microwavable

- migrate

- mikasa

- miles

- military

- miller

- milor

- minecraft

- mini

- miniature

- minimalist

- minimized

- minuman

- minus

- minyak

- mirage

- mirror

- miso

- misoa

- missing

- mission

- mizuno

- mobile

- mobiles

- mockup

- modern

- molen

- moltres

- monday

- mondrian

- monet

- money

- monitor

- monitors

- monroe

- monster

- month

- monthly

- moon

- morris

- mosaic

- moth

- mother

- mothers

- motivation

- motivational

- motor

- mountain

- mountains

- mouse

- mouth

- move

- moves

- movie

- movies

- moving

- mrna

- much

- mugs

- multi

- multiple

- multiplication

- mural

- murals

- Music

- Musical

- muslim

- mustang

- myford

- Mystery

- nagasari

- nail

- name

- names

- nanas

- nantucket

- narayan

- narrow

- nasa

- nascar

- nashville

- nasi

- nastar

- national

- native

- nativity

- natural

- naturally

- nature

- navratri

- navy

- near

- necklace

- need

- nelayan

- nencini

- neopar

- nescafe

- netgear

- network

- neuropathy

- neutral

- newborn

- News

- newton

- nezuko

- night

- niharika

- ninja

- nintendo

- nissan

- noise

- nordstrom

- north

- northern

- norway

- note

- notes

- notice

- notre

- nouns

- novel

- nożna

- number

- nurse

- nursery

- nutrition

- nyonya

- observation

- observations

- ocean

- office

- official

- often

- ohio

- olahan

- omega

- omnivores

- oncom

- online

- open

- opens

- opinion

- orange

- orchid

- order

- oreo

- organisms

- original

- orlando

- ornaments

- oseng

- outdoor

- outlet

- outline

- outlook

- outside

- oval

- over

- overwatch

- oxford

- packers

- padang

- page

- pages

- paint

- paintable

- painted

- painting

- paintings

- pair

- pais

- palembang

- palette

- pallets

- pancho

- panda

- pandan

- panel

- panera

- panggang

- panis

- panoramic

- pans

- panther

- paper

- paranoid

- paris

- parivar

- parks

- paru

- parvati

- parvo

- pass

- password

- pastel

- pasteur

- pastry

- patches

- patent

- path

- pattinson

- payment

- peaceful

- peach

- peacock

- pearls

- pearson

- pectoraux

- pediatricians

- peel

- peerless

- pencil

- pencils

- penius

- pentol

- penulisan

- penurun

- people

- percentage

- perennial

- periodic

- permanent

- permanente

- personalized

- pertussis

- pesmol

- pewter

- pexel

- pfizer

- philippines

- philips

- philly

- phone

- phones

- photo

- photography

- photos

- photoshoot

- picher

- pick

- picks

- pics

- picture

- pictures

- pieced

- pier

- pigs

- piłka

- pillow

- pimpernel

- piñata

- pindang

- pineapple

- ping

- pink

- pintu

- pipe

- pirate

- pisang

- pitbull

- pittsburgh

- pixel

- pixelmon

- place

- plague

- plaid

- plan

- planeta

- planner

- planning

- plans

- plant

- planter

- plants

- plaster

- play

- playstation

- plot

- plots

- plus

- plush

- pneumococcal

- pneumonia

- podcast

- poem

- pokemon

- pokémon

- polio

- polos

- polyethylene

- pomeranian

- pool

- porch

- positive

- poster

- posters

- postmates

- powder

- power

- practice

- praktis

- prayer

- predator

- pregnant

- premier

- prerunner

- preschool

- prescription

- present

- presto

- pretty

- preventable

- prezzo

- price

- primarina

- princess

- principles

- printable

- printables

- printer

- printing

- prints

- private

- probabili

- problems

- process

- program

- proof

- propagate

- proposal

- pros

- protection

- publish

- puding

- puff

- pukis

- pulsar

- pump

- pumpkin

- pumps

- punctuation

- puppy

- purex

- purge

- purple

- pusheen

- putih

- puyuh

- puzzle

- puzzles

- python

- quality

- quartz

- queen

- quest

- questions

- quidditch

- quilt

- quilted

- quiz

- quote

- quotes

- quran

- rabbit

- rabies

- racing

- rack

- radha

- radhe

- rahasia

- rain

- rainbow

- rainbows

- raised

- rapper

- rarest

- rash

- rate

- rating

- rawon

- razer

- reaction

- readiness

- reading

- ready

- real

- reality

- rebel

- rebus

- receive

- reception

- recife

- recipe

- recommendations

- reconstruction

- record

- rectangle

- rectangular

- redflagdeals

- reds

- reducing

- reference

- registry

- regrouping

- relax

- release

- religious

- removable

- remove

- rendang

- rent

- renyah

- repeating

- replace

- replacement

- repsol

- republic

- research

- resep

- residential

- resolution

- respiration

- respond

- response

- rest

- restaurant

- reteaching

- retrieve

- retro

- review

- reviews

- rewards

- ribbon

- rice

- richard

- ridge

- ring

- rings

- risol

- risoles

- ritter

- robert

- roblox

- rock

- rocket

- rocks

- roll

- romantic

- room

- rose

- roses

- ross

- roti

- round

- rover

- royalty

- royco

- rubicon

- ruby

- rudy

- rugby

- rujak

- rule

- ruler

- rumahan

- ruptured

- russian

- rustic

- ryan

- safety

- sakura

- sala

- salary

- sale

- salmon

- sambal

- samsung

- sand

- sandlot

- sanofi

- santa

- santan

- santas

- saphire

- sapi

- sarabba

- sarden

- sarnia

- sate

- saus

- sauth

- sawi

- saxon

- sayur

- scarf

- scenery

- scenes

- schedule

- school

- sciatica

- science

- sconto

- score

- scotland

- scott

- scrabble

- screen

- screensavers

- sculpture

- seashell

- seaside

- season

- seats

- seattle

- seblak

- second

- section

- sederhana

- sedona

- sego

- selke

- semur

- sendok

- seniors

- senses

- sentence

- sentences

- septic

- serani

- serenity

- series

- serundeng

- server

- services

- sets

- shapes

- shared

- shark

- shed

- sheet

- shein

- shelby

- sherwin

- shingle

- shingles

- shingrix

- shiny

- shipping

- shirdi

- shirt

- shirts

- shiv

- shiva

- shoe

- shoes

- shop

- shopping

- shops

- Short

- shorten

- shot

- shots

- shouldn

- show

- shree

- shri

- side

- siege

- sign

- signature

- signs

- sikhane

- silent

- simple

- since

- singapore

- singkong

- sinjay

- sinopsis

- siser

- sister

- site

- sites

- siwa

- size

- sizes

- skate

- skateboard

- sketchup

- skiing

- skills

- skull

- skyline

- slat

- slime

- slip

- slonem

- slow

- slowpoke

- small

- smallpox

- smart

- smoke

- snake

- snap

- snapchat

- sneakers

- snoopy

- snowman

- soak

- soccer

- social

- society

- soft

- solo

- someone

- song

- songs

- sony

- sore

- sorts

- sosis

- soto

- sound

- soundtrack

- soup

- south

- southwestern

- space

- spade

- spangled

- spanish

- spark

- speaker

- speakers

- spelling

- spider

- spiderman

- spine

- splash

- splatter

- split

- spoilers

- spoofing

- Sport

- sportback

- sports

- spray

- spring

- squad

- square

- squishmallows

- srbija

- stadium

- staedtler

- stainless

- stains

- stand

- standing

- star

- starbucks

- starcraft

- stark

- starry

- start

- starters

- state

- states

- status

- steam

- steelers

- stem

- stencil

- step

- stephen

- stewart

- stick

- stickers

- stik

- stock

- stone

- stonks

- stool

- stop

- stories

- story

- strawberry

- stream

- streaming

- street

- strikers

- students

- stuffed

- stup

- styles

- submarine

- subtraction

- success

- succulent

- sudoku

- sugar

- sumatra

- sumif

- summer

- sumsum

- sunday

- super

- supercar

- superman

- superteacher

- supplies

- supply

- supreme

- surabaya

- susu

- suzani

- swab

- switch

- swollen

- sword

- symptoms

- synthesis

- system

- table

- tables

- tablet

- tacoma

- tahu

- tahun

- taiga

- takaran

- take

- takoyaki

- taliwang

- tamales

- tamil

- tangled

- tanpa

- tape

- tapestry

- target

- targets

- tarot

- tattoo

- taunt

- tawar

- tdap

- teach

- teacher

- teachers

- teaching

- teal

- teams

- tech

- technology

- teddy

- teens

- telugu

- telur

- tempe

- template

- templates

- temporary

- tennessee

- tennis

- tens

- tent

- tepung

- terasi

- terbaru

- teriyaki

- terms

- terong

- test

- testing

- testosterone

- tetelan

- texas

- text

- textured

- thanksgiving

- that

- theme

- themed

- thermasol

- thermos

- this

- thomas

- thread

- three

- thrones

- throttle

- thursday

- tiffany

- tiger

- tiktok

- tile

- tiles

- time

- timelapse

- timeline

- tint

- tiram

- tires

- tirupati

- titan

- today

- toddler

- toilet

- tomat

- tomorrow

- toner

- tongkol

- tony

- tool

- toppers

- torrent

- touch

- toxic

- toyota

- toys

- trac

- track

- tracking

- tractor

- trading

- traditional

- train

- training

- transparan

- transparent

- travel

- travis

- treatment

- tree

- trellis

- trend

- trim

- trippy

- trivia

- tropical

- trout

- truck

- true

- tucson

- tumis

- tumpeng

- tundra

- turkey

- turkeys

- turn

- turtle

- tusuk

- tutorial

- twinrix

- twins

- type

- typhoid

- udang

- ukuran

- ultra

- umbreon

- under

- undercooked

- underwear

- unemployment

- ungkep

- unicorn

- unique

- unit

- united

- university

- unlicensed

- unlike

- untuk

- update

- upload

- uptodown

- urdu

- urine

- usus

- vaccinated

- vaccinating

- vaccination

- vaccinations

- vaccine

- vaccines

- vacuum

- valentine

- valhalla

- value

- varicella

- vector

- vegas

- vegetable

- vehicle

- venetian

- venue

- verbs

- verse

- versions

- versus

- vertical

- vibia

- vibrant

- video

- videos

- views

- vinci

- vine

- vineyard

- vintage

- vinyl

- virus

- visualisation

- vivo

- vocabulary

- volkswagen

- vrijeme

- vuitton

- waffle

- walk

- walkthrough

- wall

- wallpaper

- wallpapers

- walls

- walmart

- waluh

- warfare

- warm

- watch

- watches

- water

- watercolor

- watercolors

- wave

- wayfair

- weakness

- website

- websites

- wedding

- wednesday

- week

- weekly

- weight

- weighted

- west

- Western

- westie

- what

- wheelchair

- when

- where

- while

- whimsical

- white

- whitetail

- whole

- whooping

- widget

- wife

- wifi

- wiki

- wild

- window

- windows

- wine

- winelands

- winsor

- winter

- wire

- wireless

- wishes

- wisman

- with

- wolf

- woman

- womens

- wonder

- wonderful

- wood

- wooden

- woodland

- word

- words

- work

- workers

- working

- workplace

- works

- worksheet

- worksheets

- worksheetsorg

- world

- woven

- wristbands

- writing

- xray

- xvideos

- yakiniku

- yang

- yantra

- year

- yeezy

- yeezys

- yellow

- yoda

- york

- your

- youtube

- zebra

- zedge

- zelda

- zero

- zoom

- zora

- żywo